Reconciling bank statements on a monthly basis, of crucial importance in the management of cash flow, is another important task for the bookkeeper. Other aspects of bookkeeping include making adjusting entries that modify account balances so that they more accurately reflect the actual situation at the end of an accounting period. Adjusting entries usually involves unrecorded costs and revenues associated with continuous transactions, or costs and revenues that must be apportioned among two or more accounting periods. Bookkeeping involves keeping track of a business’s financial transactions and making entries to specific accounts using the debit and credit system. Every accounting system has a chart of accounts that lists actual accounts as well as account categories.

If you drive a lot to go and meet clients, your auto mileage rate of .54 per mile for an average of 12,000 miles a year would be an expense of $6,480.00. The median salary for a full charge bookkeeper with three years of experience and is Certified through one of the Certification agencies is $32,000 to $55,000 per year. Your article https://antoniolucio.com.br/cpa-boston-ma/ incorrectly states incorrectly states that almost anyone can call themselves an accountant. The State Board of Public Accountancy only allows those with licenses to call themselves an accountant. When starting your business, you can probably do your bookkeeping yourself, provided that your business is still new and small.

During an internship, you’ll probably learn about the computer programs the company uses, as well as how the company maintains accurate records and stays on top of the latest regulations. Follow these five steps, and you’ll be well on your way to becoming a bookkeeper. Salaries typically range from $35,904 to $45,891 depending on factors like location and previous experience. As of October 30, 2017, the median annual salary for a bookkeeper was $40,912.

” But in the great scheme of accounting solutions, the role of bookkeeper is to perform basic tasks. Needless to say, this isn’t a job that just anyone could do and there’s a substantial amount of training that goes into the job – not to mention a keen ability to pay attention to detail.

The CPA prepares the returns, and if they haven’t entered any adjustments throughout the year, they’ll enter them at this time. They’ll also determine the estimated payments the client needs to pay throughout the upcoming year, and make any other recommendations for tax planning. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Post A Full Charge Bookkeeper Job To 100 Job Boards With One Submission.

When the company is ready to make a purchase, a purchasing department will send a purchase order to a vendor. This document details the merchandise requested, the price and the quantity. This is a great career pathway if you find you become tired of a role easily. You will have the opportunity to move around and work in different settings so you never have to worry about you role becoming dull.

The initial processes involved in any accounting process are usually the vestige of a bookkeeper. Transaction recording lays a foundation for the final accountancy processes, and an accountant can handle this as well. Therefore between bookkeepers vs. accountants, the limitations of the bookkeeper’s skills analysis and interpretation of financial data are the main difference in professions. A bookkeeper is someone who works for a company (either as an employee or a contractor) to keep the financial books.

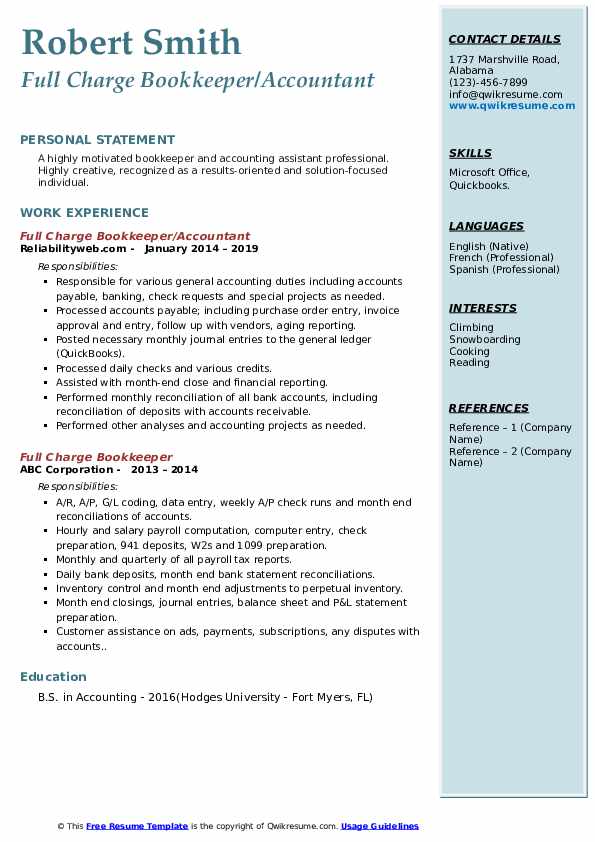

Full Charge Bookkeeper Responsibilities:

No hard and fast educational requirements exist for those wishing to become company controllers. The processing stage of the financial accounting cycle is the stage when things are recorded in the accounting system. General journal entries for business transactions are entered, and then those amounts are transferred to the general ledger. So, if a business had cash sales of $350, the journal entry would include a debit to Cash and a credit to Sales, with general ledger entries to update each account.

How do I become a bookkeeper with no experience?

In general, at least a bachelor’s degree in finance, business administration, accounting, or related area is required for CONTROLLER positions. Bachelor’s degrees in these areas provide individuals with a strong business and financial background, and the ability to make sound decisions in the field.

How Much Does A Full Charge Bookkeeper Make In The United States?

Once you have landed a role in bookkeeping, you can sharpen up your computer skills with a TAFE course if you need extra training. However, most programs will be intuitive and should not cause what is full charge bookkeeping you too much trouble. If you have started to consider a career in bookkeeping, you may have a few questions. Read on to discover the many reasons to consider a career in bookkeeping.

- The Certified Public Accountant (CPA) credential is commonly required for CONTROLLER positions.

- While bookkeepers and accountants share common goals, they support your business in different stages of the financial cycle.

- Requirements for a CPA differ by state, but majority require a minimum of 150 semester hours of undergraduate education, which is usually around 30 credits more than a bachelor’s degree.

The first step in ensuring those billable hours is to take on more clients. While this may at first require extra work to find those additional clients it will dramatically reduce the impact of bookkeeping losing a client which in turn actually makes the bookkeeping profession a more stable one. Prepares financial reports by collecting, analyzing, and summarizing account information and trends.

In no arena are companies more scrutinized and regulated than in finance. After the financial crisis of 2008, a host of new regulations dictated how businesses must handle their finances and report their financial positions to the public. Publicly traded companies must subject their financial statements to yearly third-party audits, and they must release the results of the audits to the public.

With the advances in technology, this process has been automated and improved. Businesses of all sizes are now using financial management software to streamline accounting processes and reduce human error. The different types of accounting packages available today can accomplish a variety of tasks, from data entry to e-filing and reporting. They can be integrated with other IT systems, such as CRM software or e-commerce platforms, for enhanced functionality. Some support complex operations like electronic payments, stock control and value-added tax schemes.

Is bookkeeping a good career?

The standard route starts with four years of undergraduate education with an emphasis in finance or accounting followed by an MBA. Work at a Big Four firm, and possibly a stint as a government auditor or senior-level accounting work, can lead to an assistant controller position.

Search Job Openings Search thousands of open positions to find your next opportunity. Tell us about you and get an estimated calculation of how much retained earnings you should be earning and insight into your career options. The average salary for a full charge bookkeeper is $20.38 per hour in the United States.

While the average mom and pop shop has little need for one, most SMBs will see significant value in having an accounting controller at the helm. An accounting controller is capable of handling the job duties of the average bookkeeper but in most cases acts in a supervisory capacity by answering high level accounting questions.

Whatever I do, I know this role will have given me a wide portfolio of skills I will be able to apply to various roles. Their QuickBooks duties can involve overseeing accountants or other professionals who work in the financial department of their company.

This bookkeeper sample job description can assist in your creating a job application that will attract job candidates who are qualified for the job. Feel free to revise this job description to meet your specific job duties and job requirements, and find more ideas for crafting your description by browsing Monster’s bookkeeper job listings. Having a consistent paycheck is ideal for most people and not everyone can handle the stress of being self employed. Your employer pays the match on your FICA and Medicare so your burden is only 7.65% whereas being self employed it is 15.3% of your net profit.

Accounting software has, however, automated most of these chronicle processes, and bookkeepers can summarize and classify financial report data. Such bookkeepers are known as full-charge bookkeepers and may demand higher pay than regular bookkeepers but not more than accredited accountants. We are looking to hire an experienced Full Charge Bookkeeper to handle our company’s accounts.

Where Can A Full Charge Bookkeeper Earn More?

Hugh Allon-Smith is 25 years old and an accounts assistant at Russell Smiths Accountants in Leeds. Before I started working in my current role I did a degree in Natural Sciences at Durham University and then I spent a year working for Christians Against Poverty, a debt counselling agency in Bradford. I have been considering a career as an accountant for a while so thought a job as an accounts assistant would be a good way to find out if it is something I’d like to do long-term.

Job Overview

Controllers are considered the advanced technicians of the accounting world, so they should have the skills to evaluate the effectiveness of accounting software, systems and processes, as well. CONTROLLERS need a strong background in financial management or related area, and many employers require at least five years work experience. Many individuals start out as cost accountants and advance to accounting management positions after showing financial expertise and leadership abilities.